Homeowners Insurance in and around Chicago

Looking for homeowners insurance in Chicago?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

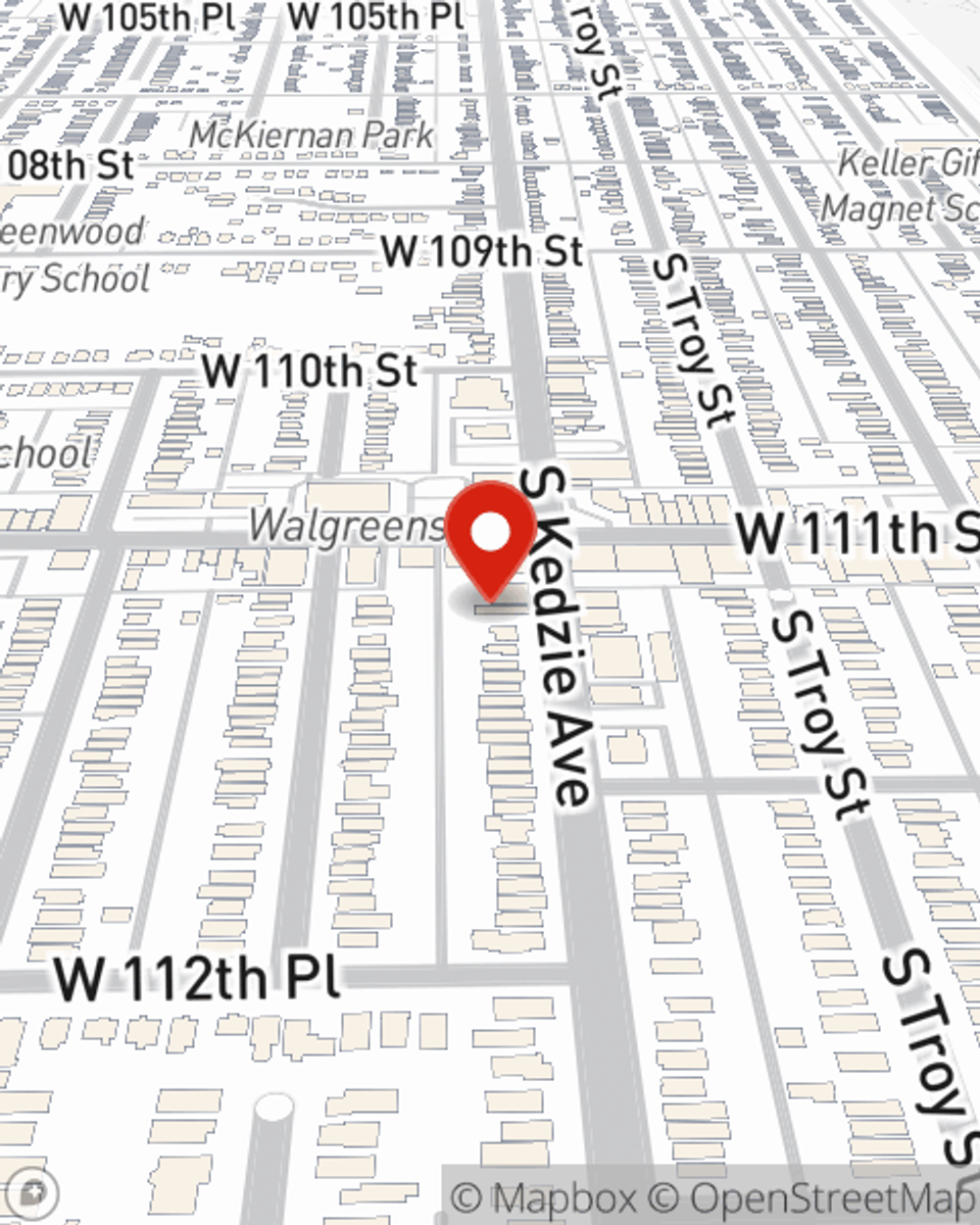

- 60655

- 60652

- 60453

- 60805

- 60462

- 60803

- 60643

There’s No Place Like Home

Home is where love resides laughter never ends, and you're protected with State Farm's homeowners insurance. It just makes sense.

Looking for homeowners insurance in Chicago?

The key to great homeowners insurance.

Why Homeowners In Chicago Choose State Farm

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s personalized to fit your specific needs. Fortunately you won’t have to figure that out by yourself. With deep commitment and outstanding customer service, Agent Chris Webber can walk you through every step to set you up with a plan that guards your home and everything you’ve invested in.

Having terrific homeowners insurance can be valuable to have for when the accidental occurs. Call or email agent Chris Webber's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Chris at (708) 385-8899 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Chris Webber

State Farm® Insurance AgentSimple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.